The little-known UN Agency in charge of guarding the ocean as the “common heritage of humanity” has been allocating exploration contracts to countries and private companies as part of the rush to mine the deep seas. But details are sparse on how these interests are supposed to share the fortune they promise lies beneath the waves.

In the shadowy depths of our oceans and in closed boardrooms, a controversial chapter is unfolding—a tale of profits, power, irregular partnerships, uncertainty, and lack of transparency that could deepen inequality and reshape the quest for global resources.

Deep-sea mining companies, driven by their pursuit of precious metals at the bottom of the oceans, have ventured into uncharted territory. Their interest has raised concerns among scientists and environmentalists alike. Critics argue that these companies are not only endangering pristine environmental areas but also potentially exploiting economically vulnerable countries in the Global South and privatizing resources meant to benefit humankind.

The potential benefits of mining have not been reliably quantified. The question of how to distribute profits from mining deep-sea resources reserved for “common heritage” or establish equitable profit-sharing formulas with developing countries remains a big question, that is not being addressed enough, according to some experts, further fueling the controversy surrounding deep-sea mining.

Who stands to benefit beyond a few powerful corporations and their shareholders, and who will shoulder the burden?

Conversations with over a dozen experts, representatives of mining companies, environmental NGOs, and on-the-ground coverage at the latest International Seabed Authority meetings in Kingston, Jamaica prove that private companies have gained the upper hand in the international negotiations for mining contracts for the ocean floor.

Our reporting shows how a single Western company through clever tactics gained deep-sea mining exploration contracts for big chunks of the international seabed reserved for developing countries.

“History repeating itself”

It is not the first time Pacific nations are on the frontline of extractive practices. Papua New Guinea (PNG) experienced firsthand the implications of partnering with Nautilus Minerals, a Canada-based company, eager to recover precious metals in the country’s waters back in 2011.

Almost eight years after the Solwara 1 project started exploring the Papua New Guinea coastline for hydrothermal vents, the mining company lost half a billion dollars in investor funds, leading to insolvency and eventual bankruptcy. This outcome had significant consequences for an already poor nation. PNG lost US$120m, equivalent to nearly a third of the country’s annual healthcare budget. Furthermore, the repercussions on ancient cultural fishing practices persist to this day.

However, the main investors didn’t suffer any major losses. Among them was Gerard Baron, an Australian in his early 40’s. A decade later, He is trying once again to mine the seafloor, this time as CEO of The Metals Company, another Canadian-based startup partnering with tiny islands in the Pacific and which could become the first venture to get a mining commercial license to exploit deep-sea resources in international waters.

Environmental international organizations and local communities in PNG warn of the chances of “history repeating itself”.

“There are many parallels between TMC and Nautilus Minerals – same founders – same modus operandi. – Dr. Helen Rosenbaum

The TMC business plan like Nautilus’ is riddled with risks relating to litigation, potential liabilities, lack of insurability, market uncertainty for the metals it plans to mine, and huge questions over technical and financial feasibility.”, says Dr. Helen Rosenbaum, Coordinator of the Deep Sea Mining Campaign.

With the difference that, this time the new Canadian player, TMC, has set its focus not on shallow coastlines but on mining the depths of the high seas. A “very lofty ambition”, in Gerard’s words, who is publicly known as the Australian Elon Musk.

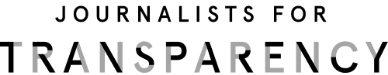

The specific target is the Clarion Clipperton Zone (CCZ) in the Pacific Ocean, between Hawaii and Mexico. This area borders the Exclusive Economic Zones of the Cook Islands, Kiribati, Nauru, and Tonga. The CCZ is a deep-sea trench approximately the size of the European Union. It holds a calculated 21 billion tonnes of polymetallic nodules or what Barron likes to call “batteries in a rock,” eluding to the metals these nodules contain that could potentially power the world needed “green transition”. TMC calculates it will get over $30 billion in profits over the 30-year mining project of these little rocks.

Global players and controversial allocations

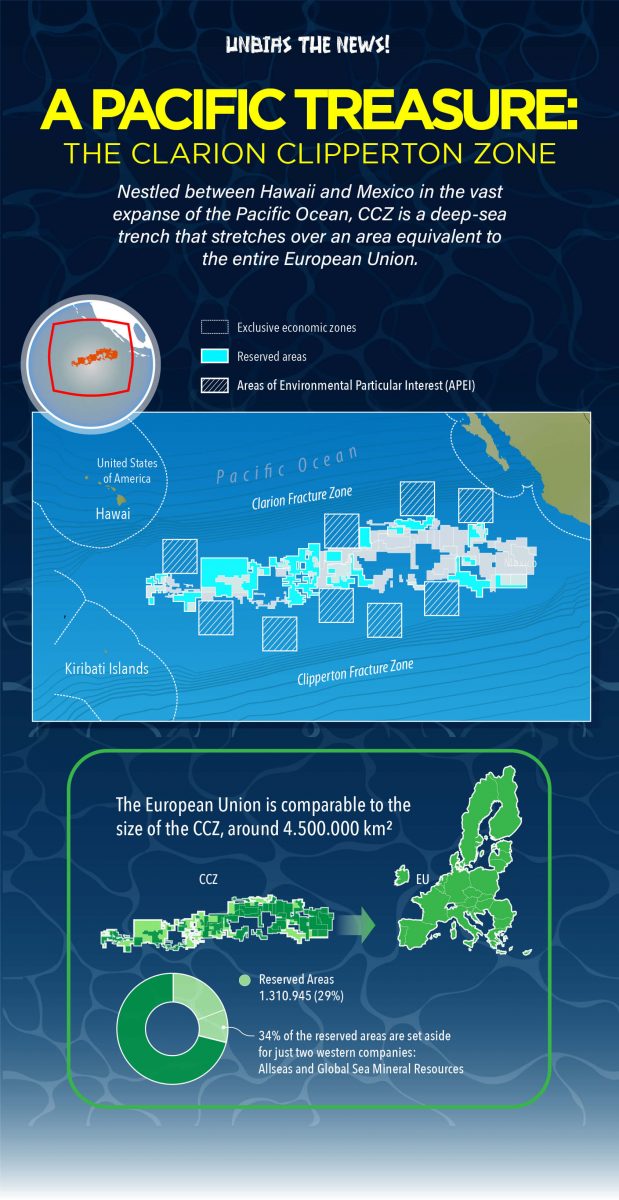

Small and little-known by UN standards, the Kingston, Jamaica-based International Seabed Authority (ISA) has the power to control and govern over half of the Earth’s planet, everywhere the deep sea bed expands across international waters. Holding the keys to the world’s underwater treasures.

SOURCE: GLOBAL OCEAN COMMISSION/ THE HIGH SEAS AND US: UNDERSTANDING THE VALUE OF HIGH-SEAS ECOSYSTEMS

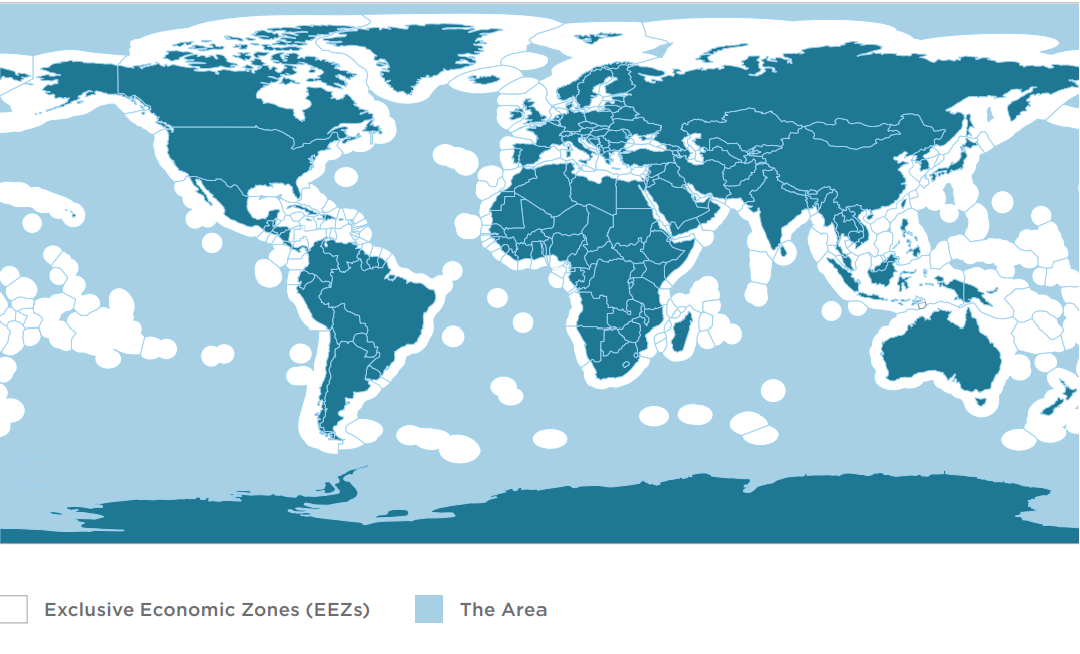

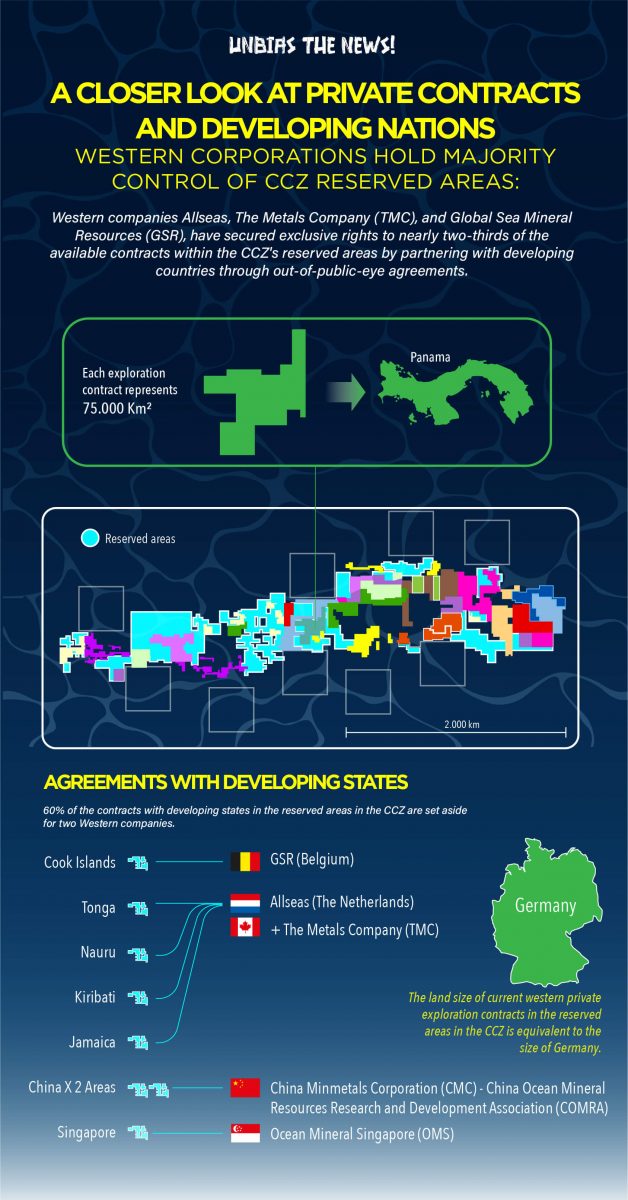

Over the past 15 years, the International Seabed Authority (ISA) has issued more than 30 exploration contracts. These contracts have been awarded to various companies and nations eager to unlock the vast resources on the ocean floor.

The ISA has not yet issued a commercial mining license to any company. However, The Metals Company is inching closer. China is just behind TMC, holding five exploration contracts over the whole international seabed.

To gain access to some of the richest square kilometers underwater, private companies find themselves tethered to a unique requirement dictated by the United Nations Convention on the Law of the Sea (UNCLOS). This stipulates that the richest portions of the international seabed resources must be set aside for developing countries. The system of so-called “reserved areas” is supposed to ensure that developing countries have access to deep-sea mineral resources and promote equity. However, the profit-sharing benefit between wealthy players and tiny islands -developing countries- and in general profit sharing for humankind as a whole has not been at the center of the discussions at the ISA.

The Authority has given out eight exploration contracts to teams of companies and developing sponsoring states to explore the richest areas of the deep sea for polymetallic nodules. TMC and its operator partner, Allseas, an offshore construction company based in The Netherlands, are in control of half of them, alltogether the area is equivalent to the land size of Italy.

A common pattern in these “exploration contracts” has been the match between wealthy investors, Western companies, and small developing countries. As such, TMC, partnered with three little Pacific island nations: Nauru, Tonga, and Kiribati, to explore and potentially exploit the seabeds for metals. Promising a tale of potential profits for the economically challenged countries. However, details of these agreements are not disclosed.

Jamaica is the latest small island to become a sponsoring state to a new contractor, Blue Minerals Jamaica Ltd, which is actually a subsidiary of Allseas, a company connected to the Swiss Allseas Group and the same company owning the vessels that seeks to mine all three areas granted for exploration to The Metals Company.

In that sense, a family-owned, Western company (Allseas) is in charge of the future operations of deep-sea resource exploitation in nearly 50% of the reserved areas for developing countries in the CCZ with exploration rights so far. Other similar partnerships exist between Global Sea Mineral Resources (GSR), a subsidiary of the DEME Group, a Belgium company working with Cook Islands, which holds contracts to 11% of the Area.

In short, over 60% of the contracts currently available between private players and developing states in the reserved area in the CCZ have been set aside for only two Western private companies with out-of-the-public-eye agreements with developing nations.

A system “open to abuse”

According to experts, this strategy has led to the privatization of significant portions of the seabed through a “cunning ruse” that essentially conveys that certain governments could grant access to particular international seabed areas for mining, with the condition that the benefits were distributed to society as a whole.

“It is a system open to abuse”, Pradeep Singh states. He is an expert on ocean governance and climate policy and a Fellow of the Research Institute for Sustainability in Potsdam, Germany.

“Essentially, it is a link in a chain of people profiting from a resource that should, by its very nature, be considered a global commons”, says Andrew Whitmore, the Finance Advocacy Officer at Deep Sea Mining Campaign by the Ocean Foundation. However, “what they’ve done is they’ve created a system that effectively backs or privatizes it. The issue here is that individuals are making money off of this backdoor privatization”, he continues.

Why would foreign companies want to partner with these small developing countries in the first place? Can these collaborations be advantageous for the developing countries?

It’s a fact that these smaller countries lack the capability to develop the technology and resources needed for such a costly undertaking. Instead, they find themselves in a fragile position where they have to rely on external expertise, technology, and financial assistance. This situation can lead to what environmental law experts describe as an “opportunistic effort.”.

The ISA governs this process, but numerous researchers argue that it is “poorly executed.” It is worth noting that the ISA has faced significant criticism for its perceived lack of transparency and close ties to corporate interests in its management of deep-sea mining negotiations.

Some ISA meetings, which carried monumental implications for the utilization of resources belonging to all of humanity have been attended by politicians, company owners, and representatives from nearly 200 nations with vested political and economic interests, who sit comfortably in the chamber. Yet, the scarcity of journalists at the latest ISA meetings underscores a troubling imbalance.

“It is like to ask the wolf to take care of the sheep” remarked Sandor Mulsow, a marine geologist who held the position of the authority’s chief environmental officer for five years during an interview with LA Times.

PHOTO CREDIT: GABRIELA RAMIREZ

A “flawed model”

One of the mandates of the ISA is to ensure the exploitation of seabed resources “for the benefit of humankind as a whole.”

But as exploration campaigns uncover vast reserves of metals, the question looms large: How will the profits be shared? What are the proposals to make it equitable and beneficial to humankind? International discussions on this core issue are lacking.

In fact, the main model being used as a reference point for future deep-sea mining profit sharing comes from a “flawed model” or the MIT model, as it is known since it was developed by the Massachusetts Institute of Technology on request from the ISA Secretariat back in 2017. The proposed MIT model doesn’t take into account environmental externalities or that these mineral resources are a global commons, which basically backfires on the social equity aspects of the ISA mandate.

Fortunately, several delegations have brought up these concerns. Delegates from nations such as Germany and Costa Rica have emphasized the necessity to substantially raise the payment rates, well beyond the initial proposals and what the contractors were initially willing to offer.

“It is evident that the current proposals fall short, especially since they do not adequately factor in the environmental costs”, adds Pradeep.

“A can of worms”

Amidst the numerous uncertainties surrounding this issue, certain established aspects give experts reasons for skepticism regarding the potential advantages of deep-sea mining and whether it can truly be made mutually beneficial for the wider population, rather than exclusively benefiting a select few directly involved in deep-sea mining operations.

The ISA will need to allocate the incoming funds to several essential purposes. Firstly, it must cover its own operational expenses. They must use the revenue from contractors to provide compensation to land-based mining nations that experience losses due to deep-sea mining activities affecting their terrestrial mining operations.

After accounting for all these financial obligations, which are at ISA’s discretion, there may be a possibility that the ISA operates at a deficit due to insufficient incoming funds, some experts advise.

“To make the ISA financially viable, it might need to approve a substantial number of mining activities. However, approving a large number of mining applications could lead to an undesirable situation where the ocean’s capacity to support such activities is exceeded,” Pradeep explains

“It is a can of worms that we don’t want to open”, he remarks.

Benefit-sharing: “More questions than answers”

So far the calculations on potential revenues from deep-sea mining are merely for “notional purposes” assuming that no matter how much money is made, the way the money is divided would stay the same. However, recent independent research under the Pew Charitable Trusts ‘Code Project’ argues that the amount of money made from deep-sea mining does matter. It matters because it helps the countries involved in designing how to use that money. It helps people understand whether deep-sea mining will really benefit everyone, as required by international law. Without this information, people might have “unrealistic expectations” about the financial benefits of deep-sea mining, the paper notes.

The African Group of ISA member countries reached a similar conclusion in a joint statement to the Council of the ISA in February 2019:

“In net present value terms, the total compensation to mankind with a 2% and then 6% royalty would be $490 million. This represents just $2.93 million for each of the ISA’s 167 members (excluding the EU) over the 30-year life of the exploitation contract. This means that each of these ISA members would receive on average in net present value terms, approximately $97.8 thousand per year. The African Group does not consider that this is fair compensation to mankind”

“If deep-sea mining doesn’t make sense from a benefit-sharing perspective, then it doesn’t make sense to allow it at all,” affirms Pradeep, who has seven years focusing on deep-sea mining policy research and who also participated as an observer at the latest ISA meeting.

However, for some, the significance extends beyond mere “financial advantages.”

In fact, the requirement for “equitable benefit-sharing,” as outlined in Article 140 of UNCLOS, encompasses the fair distribution of not only financial gains but also “other economic benefits.” While the precise nature of these additional benefits is not explained in detail, some delegates from mining companies -and even the General Secretary of the ISA, Michael Lodge, have previously alluded to a range of potential benefits for “humankind”, with a primary focus on the technology ubiquitous in our daily lives, such as phones, computers, or more distinctively, those who can drive Teslas.

“Everybody in Brooklyn can then say, ‘I don’t want to harm the ocean.’ But they sure want their Teslas.”, said Lodge reported by The New York Times.

Yet, mining companies affirm deep sea mining would be more beneficial and less detrimental to our environment than current terrestrial mining practices in places like Indonesia or Congo, often linked with child labor and human rights violations.

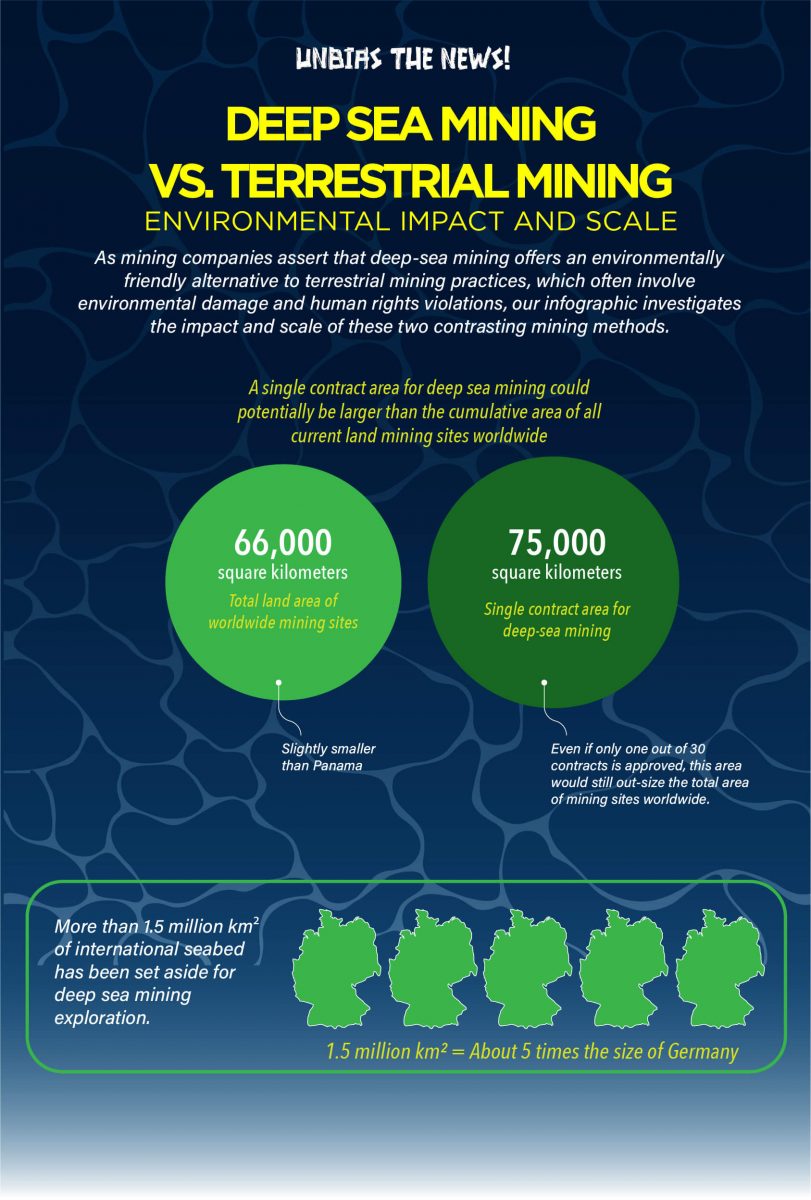

Terrestrial mining operations currently span an estimated 66,000 square kilometers of land on Earth, nearly equivalent in size to Lithuania, one of Europe’s smaller countries. Remarkably, if just one contract area for deep-sea mining exploitation in the seabed, covering 75,000 square kilometers, were to gain approval, it would surpass the combined land area of all current mining sites around the world.

Overpromises and mere opportunism?

Private companies insist they will adhere to UNCLOS guidelines, distributing revenues with the Pacific nations sponsoring their endeavors. But the ISA hasn’t yet started the debate about profit-sharing mechanism-what to do with the profits generated from mining exploitation.

Pressed on the sharing formula or the percentage that will go to the Pacific nations, Rory Usher, TMC spokesperson, said TMC doesn’t have the number yet because they have not started production.

Royalties per tonne of nodules, local taxes, and substantial investments in host nations are among the ways TMC says they plan to contribute to the local economies in their sponsoring states, such as Nauru. However, experts mention that this is questionable as contracts between the companies and sponsoring states are not public.

“We expect to be probably the largest contributor to Nauru economy once we get into first production,” Usher affirms.

Collectively, only between the Nauru and Tonga areas in the CCZ, TMC said there are an estimated 1.6 billion tonnes of nodules – enough nickel, copper, cobalt, and manganese in these two areas to electrify 280 million vehicles, equivalent to the entire US passenger vehicle fleet.

Usher said 90 percent of the investment is focused on Nauru’s exploration area in the CCZ. Nauru and Kiribati, two phosphate-rich islands, still bear the scars of mining from the colonial era. The two island nations are vulnerable to the impacts of climate change such as rising sea levels, coastal erosion, and droughts, and still have very few opportunities for economic diversification.

A Greenpeace report found the leading proponents for deep-sea mining in the region are corporate entities that are “geographically, politically, and economically removed from the small island nations that will bear the brunt of the consequences.”

Despite these promises, concerns linger. Juan Jose Alava, principal investigator, of the Ocean Pollution Research Unit, Institute for the Oceans and Fisheries at the University of British Columbia, is unfazed by the profit-sharing formula proposed by TMC. He said the company will want to, first, make profits after making huge investments in offshore exploration.

“They (TMC) would like to recoup their investments, so, not too much will be given to the people. If at all, they would benefit very little from it,” he said.

In 2021, non-fillet frozen fish was Nauru’s largest export with $123 million. Thailand was the top destination with $92.1 million in exports. Phosphate was the second largest export. The total amount of calcium phosphates exported in the country was $31.7 million during the same period.

A race for geopolitics matters

“The U.S has no voice in these discussions, but we are gonna be severely impacted by the decisions made”, says Uncle Sol, a native indigenous Hawaiian who participated as an observer with Greenpeace at the latest ISA meetings in Jamaica last July.

Indeed, the United States opted not to ratify the treaty, consequently excluding itself from the Authority and limiting its influence on shaping deep-sea mining regulations. However, the U.S. does participate as an observer in these discussions, although it lacks voting privileges. Remarkably, the United States remains a primary focus for lobbying efforts by TMC’s executives.

TMC leadership has been trying to convince American personalities that mining deep-sea minerals could provide an alternative source for critical minerals in the country, which aligns with a 2019 report from the Department of Commerce, which emphasized the need for the U.S. to mitigate the risk of dependency on critical mineral sources located in countries like China and Russia.

“China’s carefully orchestrated strategy is seeing it catch up fast. At stake is access to the planet’s largest source of energy transition metals. Regulations, as mandated by UNCLOS, are close to being final, and maybe only then the sleepy West will awaken to what’s been on offer. Of course, by then, it’s game over. Sound familiar?”, he wrote on his LinkedIn profile.

Critical minerals play a crucial role in the U.S. economy, impacting various industries such as transportation, defense, aerospace, electronics, energy, agriculture, construction, and healthcare. However, the U.S. has become more dependent on foreign suppliers for these minerals in the last 60 years, according to the U.S. Geological Survey (USGS).

Uncertain roadmap for deep sea mining

After five weeks of intense discussions and growing pressure to “stop deep sea mining”, delegates to the ISA council —the organization’s 36-member-state policymaking body —agreed that the regulatory framework to start industrial-scale seabed mining is not ready yet. It has now set 2025 as the new deadline for developing mining rules.

The ISA already missed the first deadline for regulations fixed for July 9, and some delegate members already anticipate that the 2025 deadline is rather unrealistic since it is not binding either. However, since the deadline for regulations was missed, mining companies can now apply for an ‘exploitation contract’ to be considered in light of another controversial issue, the 2-year rule. This is a goal that TMC continues to pursue despite the setbacks. It recently announced that the company intends to submit an application for commercial mining after the ISA meeting in March next year.

A TMC spokesperson stated that the review process would take at least a year. “If everything goes as planned, we are looking at starting the first production around the end of 2024, or the beginning of 2025.”, Usher said. If denied, for instance, he said the ISA will set out requirements that will need to be fulfilled, and then the application goes for another review.

“No Free Lunch”

Multiple governments, including France, Chile, and Vanuatu, and over 760 scientists and marine experts worldwide have signed a petition calling for a pause or even ban on deep-sea mining. Their goal is to ensure that environmental, social, and economic risks are better understood and that other alternatives to deep-sea minerals have been explored before the world decides to “sleepwalk into seabed mining”

However, the road to a moratorium has many layers. In fact, this is a term that does not exist in the legal framework that rules the ISA. “People need to understand that the mandate of the ISA is to make seabed mining happen,” said one of the delegates at the ISA summit in July. “A mandate that is rather controversial. For some, it is also “outdated” or “not fit for purpose”.

“On the one hand, to regulate mining – on the other hand, to protect the marine environment. These two are irreconcilable,” says Farah Obaidullah, an ocean advocate and founder of Women4Oceans about the ISA mandate.

In that sense, Obaidullah considers that “the rules need to change given the reality we are in.” She noted that the ISA was developed at a time when we were not concerned with the type of crisis we are concerned about today: climate change, biodiversity, and pollution crisis “We need to think of the deep sea and how it would serve us in the future, in terms of our health and our survival”, she adds.

However, “Nothing we do as a human society comes without environmental risks”, reflects Jeffrey Drazen, a scientist, and professor at the University of Hawaii at Mānoa. He is also part of the team of scientists collaborating on The Metals Company’s environmental assessment of seabed mining.

Drazen acknowledges that the core challenge is assessing whether the benefits of obtaining deep-sea mineral resources outweigh the potential harm to our ecosystem, which plays a crucial role in supporting the well-being of our planet and its inhabitants. This includes vital functions like carbon sequestration, and preservation of biodiversity, both of which are also essential for mitigating climate change.

“There is no free lunch, something has to get impacted in some ways,” says Usher.

But the question is, at what cost?

“Economics wins out over nature all the time,” reflects Ekolu Lindsey, the president of Maui Cultural Lands, an organization dedicated to the preservation of Hawaiian culture. “It’s very rare that nature gets a win and if it does get a win, that’s because economics is still winning something” he adds.

It remains to be seen who will benefit from the ocean riches, and whether or not they can be effectively utilized for the good of mankind as a whole. Yet, the lack of proper governance has led to the mismanagement of the seabed resources and the consolidation of control over these resources by a privileged few. Unless this issue is addressed, our ocean’s “common heritage” will continue to be at risk.